The year 2020 will go down as a year that we will never forget – even though most of us probably do want to forget. With this mad world around us, we should be taking time to pause and reflect on where we are, what our goals are and how to get there. One of the environmental considerations will surely be the massive negative impacts that Covid-19 is having in our daily lives. 2020 is the year that saw:

- COVID-19 outbreaks and the subsequent lockdowns which grinded our economy to a halt

- South Africa going into a technical recession

- Status downgrades by rating agencies

- Rising consumer inflation and reduced consumer spending

- Continued load shedding

- Poor currency performance

- Budget deficits

- Widespread corruption

- Financial distress and bail-out requirements of SOE’s (State Owner Enterprises)

As an SMME (Small, Medium and Micro Enterprise), these points above have certainly run through your mind. With mounting debt (creditors knocking at the door) and dropping revenue, your thoughts are most probably revolving around survival – specifically the “how do I survive?” part. To answer this question, we will explore ‘business rescue’ as a viable option.

Firstly, to understand business rescue as an option, we must also understand business turnaround and liquidation.

Business Turnaround vs Business Rescue vs Liquidation

There are certain traits that a business possesses that are used to distinguish between which options are viable. To do this, let us go through each option with its associated business traits:

- Business Turnaround

- Business is not financially distressed or insolvent.

- Business is however experiencing difficulty and losses which if unchecked will lead to financial losses and the need to consider business rescue or liquidation

- Opportunity for the business directors to engage with turnaround specialists/business advisors

- High prospects of survival

- Business Rescue

- Business is financially distressed

- Business is not insolvent but will become insolvent within six months

- Reasonable prospect of survival

- Action to initiate business rescue and follow the legislative process

- Liquidation

- No hope of recovery

- Business turnaround and/or rescue has failed

- Initiate liquidation proceedings

- Assets will be realized and generally reduced dividends will be paid to creditors

- No jobs retained

Note the differences in each option: each has different characteristics which can be used to determine which option would suit the business best. Business rescue resides in-between business turnaround and liquidation.

Business Rescue explained

Business rescue is a legislative process aimed at aiding financially distressed companies reorder, reorganise and restructure their affairs to create a more positive outlook for the existence of the company, their employees, their creditors and any other person that may be affected should the company cease trading.

Business rescue was enacted through Chapter 6 of the “new” Companies Act No. 71 of 2008. Chapter 6 was amended shortly thereafter by Companies Amendment Act No. 3 of 2011 and this stands as the rules and guiding principles for companies seeking to enter business rescue.

According to Section 128 of the Companies Act No.71 of 2008, a company in business rescue:

- Is placed under the temporary supervision of a business rescue practitioner

- Is afforded temporary moratorium (stay) of its claimants (including creditors)

- Is afforded an opportunity to present a restructuring plan with the main aim being to “maximize the likelihood of the company continuing in existence on a solvent basis”, or to realize better returns when compared to liquidation.

Other aims of provisions of Chapter 6 include:

- Balancing all stakeholders interests:

- Shareholders

- Employees

- Directors

- Creditors

- Unions

- Any other affected persons

- Protection against “irrational” lenders

- Creating a more sustainable future for the company going forward

- Promoting the retention of jobs and accountability of management

Some of the realities of business rescue

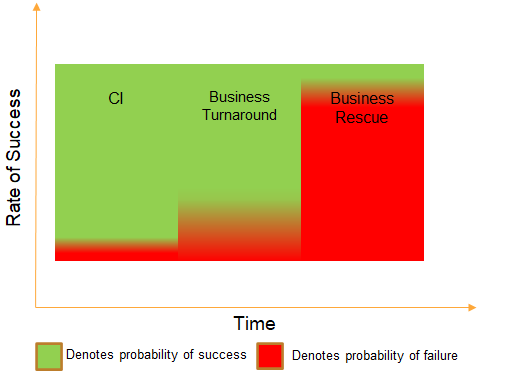

Business rescue as an option is just under 10 years old within South Africa and only boasts a success rate between 10% and 15% which is pretty pale. I will use the illustration below to explain why this is the case. There are three broad columns or headings on the graph: Continuous Improvement (CI), Business Turnaround and Business Rescue.

Organisations that have a CI mindset are proactive in driving out waste and growing their businesses to be sustainable and profitable entities. Hence, their rate of success (denoted by the green shading) is high as they are better equipped to ride out the storm. On the other hand, business turnaround is when the directors realise that they are working hard but not seeing benefits. In fact, they may be in the earlier stages of not seeing profits and have mounting debt. At this stage, engaging with a business advisor or turnaround specialist will still result in a high possibility of success and business recovery.

One major reason for the low success rates of business rescue is due to the many cases of businesses that are in the “too little, too late” stage and are on the brink of collapse. The directors have let the situation get to the point that recovery is difficult even after entering a formal business rescue process. For business rescue to become a viable option with a higher success rate, having the right skill set (business rescue practitioners) and initiating the process at the correct time is critical.

Conclusion

Many do not want to consider business rescue, probably because of the negative connotations associated with it. However, as a business owner, this cannot be a decision based on emotion but should be based on what decision and process will give you the highest probability of success. Business rescue is an opportunity for you to:

Step Back > Rethink > Restructure > Survive.

Authors

Kubeshan Govender is a candidate attorney with 9 year’s experience, particularly in the fields of liquidation and business rescue. He is also a co-director of Fulcrum Venture Capital. I have through coaching and mentoring from Nikshen Consulting, improved my globular understanding of business and realized the role of strategies planning in the longevity of business which I can use in legal practice.

Dr Kenneth Moodley is an experienced supply chain and business professional with over 25 years’ experience. He has a demonstrated history of working with both big corporates (example: Unilever & The South African Breweries) and SMME’s (Productivity SA) in various industry sectors as a senior Supply Chain Specialist, Leader and Business Coach. In addition to his supply chain experience, he is a skilled business turnaround strategist and is a registered senior business rescue practitioner.

![Business Rescue as an option for SMME’s [Kubeshan Govender]](https://nikshen.com/wp-content/uploads/2020/09/Business_Rescue.jpg)