Passive income is seductive. I only found out about passive income when I entered the job market – since then, I have been obsessed. The idea that you can earn money without actively putting in the effort seemed like the pinnacle of money-making machines. However, after a few years of nurturing this obsession, I realized that:

- It is not easy as online “gurus” make it out to be

- You are more likely to lose money than to make money

- It takes a very long time to establish

While the above points are true, we thought it would be a good idea to discuss active and passive income, as it will open your mind to new and exciting ideas to make money outside of traditional means. In this article, we are going to outline the differences and mechanisms of active and passive income. We are then going to focus on passive income – its importance, its characteristics, its advantages and disadvantages. The article will end with some examples and closing thoughts.

The mechanics of active and passive income

We mostly know and understand active income, so let’s go through it quickly. Active income is the income you earn when you physically have to “show up” – you have to develop the software, represent someone in court or turn a screwdriver. Active income (salary) is governed by the following equation:

Salary = Number of worked hours [h] x Rand per hour [R/h]

Most jobs requests you to work 40 hours per week. Your “Rand per hour” is based on your skills and experience. Your salary is the product of these two factors. When you work overtime, your “Rand per hour” and your hours both increase. Notice that a salary is dependent on you actively showing up, that is the key difference between active and passive income.

Passive income is the process where you allow your money (or skills or knowledge) do the work for you. Because of this, you do not need to show up every day to get paid. Passive income is earned when a person is not actively involved in making that money. Based on this definition, pure passive income does not exist, because there has to be at least some initial effort to set up the passive income process. No strategy is truly 100% passive. Most passive income strategies require you to put in a lot of effort upfront to build up your money-making machine. Once established, you get paid from it over a long period of time.

Why passive income is more important than you may think

Passive income is important because it is independent of effort. You do not need to constantly show up for it to make you money. Passive income buys time, and time is the difference between being rich and being wealthy. As humans, we cannot work 24/7 – but money can. Money has no emotion. It does not need to sleep or eat. Simply put: money is the best employee, so make it work for you by using it to create a passive income stream. If done correctly, passive income can also be very tax efficient.

Passive income can create a steady stream of income independent on your abilities, your time or your health. It can allow you to have less reliance on your paycheck and free up your time for you to do the things you want to. It sounds cliché, but passive income is how to “make money while you sleep”.

Characteristics of passive income

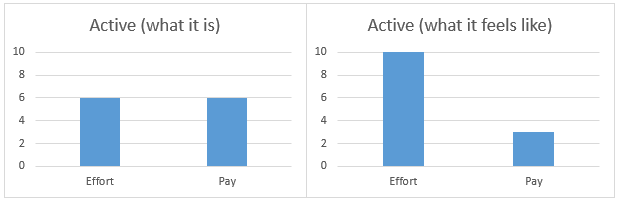

Passive income is a very efficient method for generating money if you analyze the ratio between effort and reward. For comparison, analyze the traditional 9-5 job where you are paid in relation to your hours and effort (left graph below), although it does sometimes feel like the graph on the right:

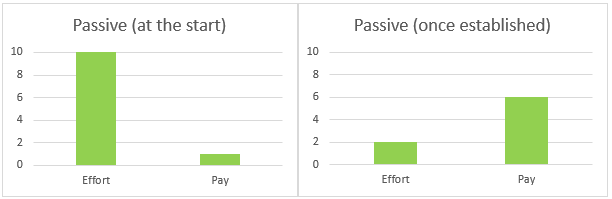

Compare the above graphs to the passive income graphs below (these ratios were adjusted from Mike Bellafiore’s “One Good Trade”). At the start of your passive income journey, you are going to spend 10X effort to receive X rewards. However, once established, your passive stream of income can reward you with 3X rewards for every X effort.

No perfect passive income strategy exists. In one way or another, you are going to be challenged: either intellectually, physically or financially. Most passive income streams start off very slow, and gain momentum over time. There is no get-rich-quick scheme.

There are many examples of passive income. Some examples are long term investing, dividend investing, affiliate marketing, swing trading, royalties from a book and owning rental property. Note that each strategy has its own unique challenges and perks:

- Long term investing can be passive (eg. value investing), however it requires lots of money and research, and the risks of losing money is high.

- Dividend investing is highly passive, however the annual returns are very low. You need a lot of money to make it feasible.

- Swing trading can be done for 10 minutes a day, however you need years of experience, capitalization and emotional control to not lose money.

- Royalty payments (eg. from writing a book) requires lots of effort to build up an audience and to publish. You would have to be an expert in the field you are writing about.

- Owning rental property is a “safe” investment, however it has a high barrier for entry and properties require maintenance. If you have to continuously tend to your brick and mortar, then is it really passive?

The above list is not exhaustive – there are many more passive income strategies in the digital and financial markets. The bottom line is that no perfect system exists. Note that if you establish a passive income strategy, you will have to spend some time increasing its value or improving its efficiency.

Is passive income worth it? Absolutely. Based on your goals, willingness to work and appetite for risk, passive income can be a liberator and can completely change your financial health.

Closing thoughts

We hope that this article has got you excited about passive income. It is different to conventional money-making methods, so take some time to wrap your head around these ideas. I would suggest to use this article as a primer and to do your own research – I find that the best information usually comes from the people actually involved in what you want to achieve.

Should you have any questions or suggestions, feel free to reach out to us through the “Contact Us” page on this blog, or comment below. If we receive enough responses for this blog, I will create an easy-to-follow video explaining (in more detail) how passive income works and how you can use it to improve your financial situation.

About the author

Trishen Naidoo is the director of Pneuma Capital and co-director of Fulcrum Venture Capital (FVC). FVC have enlisted the services of Nikshen Consulting for business coaching and guidance.

![Active and passive income [Trishen Naidoo]](https://nikshen.com/wp-content/uploads/2021/02/Income-Growth.jpg)