The article uses one of my recent coaching and advisory collaborations with an entrepreneur running a small business. The key reasons for this relationship being initiated and growing was that the business owner had the following complaints or symptoms:

- We seem to be battling with our cash flow and need to constantly rely on overdraft facilities

- Notwithstanding the impact of Covid-19, we have a healthy order book but don’t seem to be making profit

The article will cover the journey we took in detailing the scope, analysis completed, actions taken, and the results seen.

Note: I have purposefully not mentioned the business name, changed some of the numbers and will make broad statements in certain instances to protect the confidentiality of the business.

Background

The primary reasons for the business owners engaging with me were due to certain pain points that they consistently experienced around cash flow constraints, rising debt and high turnover with low/no profitability. They worked extremely “hard” and put in long hours to continuously drive the acquisition of new clients and sales. Due to this they could boast a healthy-looking sales order book and yet they still experienced the above-mentioned challenges.

Business information

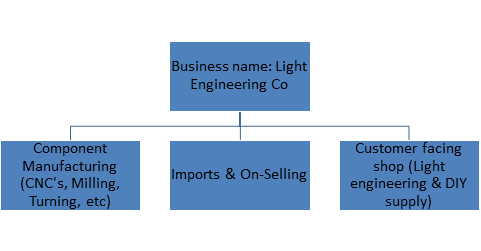

The business in question is considered a small business with a turnover of approximately R14 million per annum (2019). The organisation employs 20 individuals across it manufacturing, sales, admin and management structure. They are considered a light engineering and industrial supply industry who services a set clientele base as well as walk in customers. The below diagram illustrates the business pillars that generated income.

1. Component Manufacturing (CNC’s, Milling, Turning)

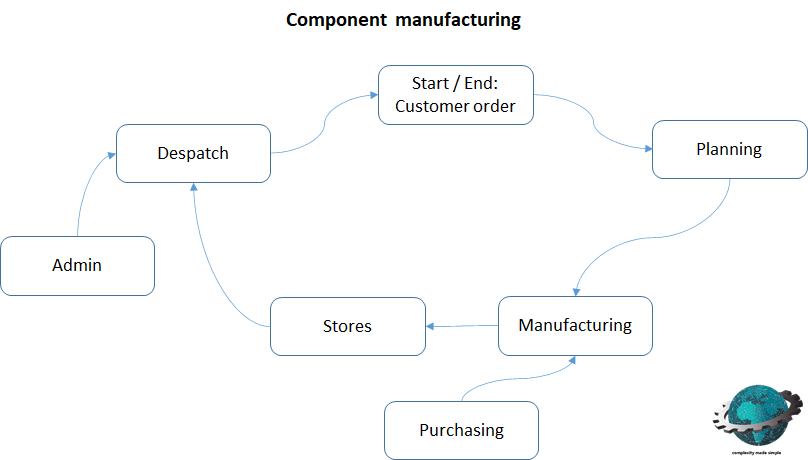

Components for refurbishment are either brought in by clients or picked up, planned and ‘reworked’ within the factory. A variety of CNC equipment is available to conduct milling, turning, drilling, polishing, etc). This business pillar includes inbound, storage, manufacturing, packaging and despatch. It is underpinned by the planning and admin functions. The SKU (Stock Keeping Unit) or product range equates to approximately 100 products.

2. Imports & On-Selling

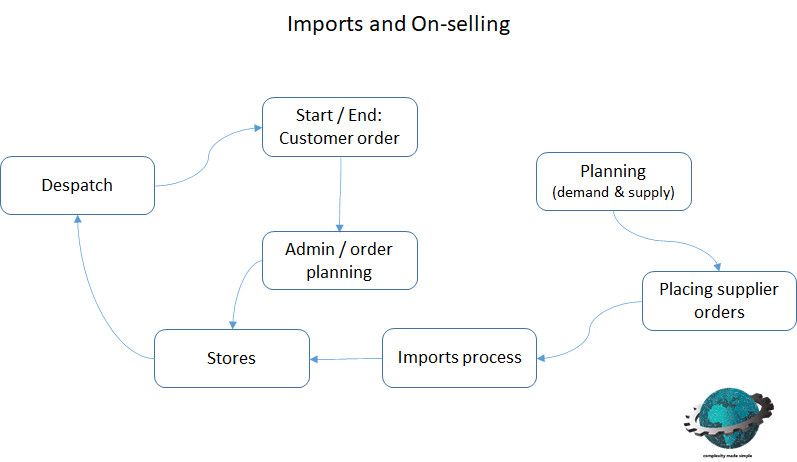

Off the shelf products are imported and sold on to the local customer base. No further work is done on these products. Products are shipped into the country, stored and sold based on customer orders. The SKU range equates to approximately 35 products.

3. Customer facing shop (Light engineering & DIY supply)

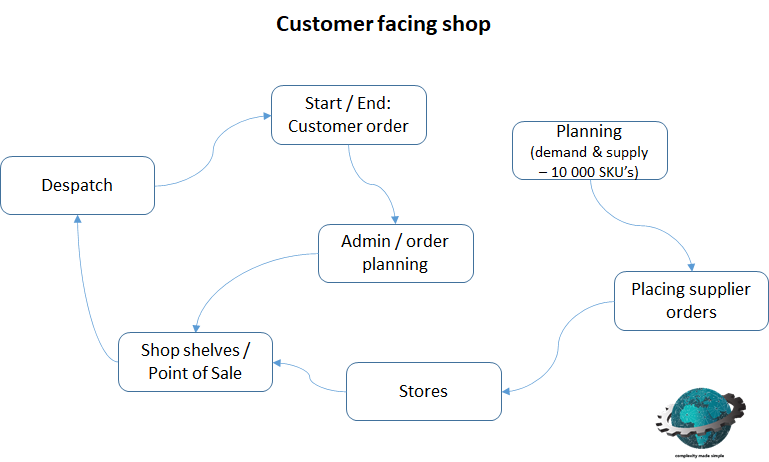

A wide variety of products are purchased from local suppliers and either sold to walk-in customers or via a order and delivery system. The approximate number of products range from a drill bit to a compressor and is upwards of 10 000 SKU’s.

Each income stream or pillar above has its own supply and value chain which required analysis and understanding to enable optimisation.

Scope of work

The key challenges we focused on where:

- Cash flow issues

- A growing overdraft facility (rising debt)

- Little to no profitability

High level supply chain maps

Below are three illustrations reflecting a view of each business pillar.

1. Component Manufacturing (CNC’s, Milling, Turning)

2. Imports & On-Selling

3. Customer facing shop (Light engineering & DIY supply)

A pareto was conducted per pillar with further analysis being conducted on the key products.

Some of the actions taken and results achieved

A number of recommendations and actions were implemented during the duration of these projects and business coaching sessions. Below are some of the highlights:

Actions taken

- Analysis completed to understand key products and focus areas.

- Process mapping completed to understand each value stream.

- Business financials analysed to understand loss and waste areas. A few key areas were identified (example: High expenditure on sales fleet).

- Completed product costing and break even point.

- Pareto Detailed product costing done on selected products to evaluate profitability and if pricing was correct. We found that it was not and that the deep discounts given resulted in losses.

- Analysis on the front of shop products completed to determine A, B & C products. In other words what are the faster sellers.

- Costed the options of normal and special deliveries for certain products and the impact on profits

Results achieved

- Reduced fleet size, operation model and overall business spend in this area. Approximate annual savings of 3%.

- Pricing on import products resulting in acceptable profit margins (net profit before tax) being realised (approximately 10%).

- Front of store product analysis resulted in the business understanding that there has to be a 30% markup on products to reach breakeven point.

Conclusion

The above is one of the success stories which I wanted to share and seeks to give you some insights into the actions and results achieved. I must stress that this was not achieved solely because of my contributions. One of the key reasons for the success was the leadership team of the business realizing the issues, that they needed help and embracing the process to find and implement solutions. Change can be difficult but once you start the journey the benefits are worth it.

Author

Dr Kenneth Moodley is an experienced supply chain and business professional with over 25 years’ experience. He has a demonstrated history of working with both big corporates (example: Unilever & The South African Breweries) and SMME’s (Productivity SA) in various industry sectors as a senior Supply Chain Specialist, Leader and Business Coach. In addition to his supply chain experience, he is a skilled business turnaround strategist and is a registered senior business rescue practitioner.